Centralized vs Decentralized Crypto Exchanges

17/03/2023

1.34k

Table of Contents

Hi everyone, It’s Binh again. I am writing this as the 3rd blog post in the blockchain technology blog series. Please be sure to check my previous posts in the series which are: Exploring The Opportunities Of Blockchain Development and Welcome To Chapter 3.0 Of The Web: The Business Model And User Benefits.

After covering the basic concept of Web3, which is still in the conceptualizing phase, I would like to return to the reality of the current solution in the market in this post so that you can have a more practical view of how Web3 should be used and built.

What is the most used blockchain solution currently? Of course, most current internet users would say it is a cryptocurrency exchange. Yes, despite the doubt about cryptocurrency’s feasibility and toxic news about highly speculating trading, the cryptocurrency exchange is undoubtedly the most popular blockchain application in the market. Today, I will dig deeper into this application and how it is built as a Web3 application. At the end of this blog, you will have a clearer understanding of the decentralization concept of Web3, especially how it is different from Web2-like centralized solutions.

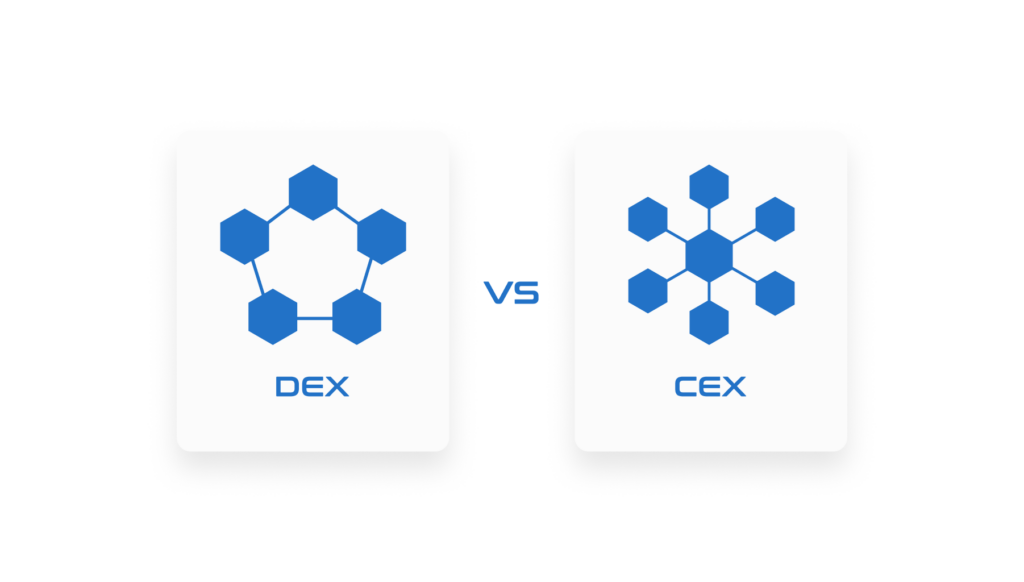

I heard about CEX and DEX, but what are these keywords really about?

In the world of cryptocurrency trading, there are two primary types of exchanges: centralized exchanges (CEX) and decentralized exchanges (DEX). While CEXs like Binance and Coinbase have become the go-to for many traders due to their user-friendly interfaces and high liquidity, they also come with significant risks. On the other hand, DEXs like Uniswap and PancakeSwap offer greater security and privacy but at the cost of lower liquidity and a steeper learning curve. Next, I will guide you to explore the key differences between these two types of exchanges and why the rise of DEXs brings us closer to the original vision of a truly decentralized web.

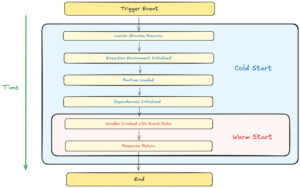

You are not holding a real crypto asset while trading in a centralized system like CEXs

CEXs are built around a traditional model of finance where a single entity controls the platform, holding custody of users’ funds and acting as an intermediary for all transactions. This means you do not have tangible crypto assets if you trade on these platforms. You are just trading a number in your account stored in these apps’ databases. While this model has allowed for the rapid growth and adoption of cryptocurrency trading, it also presents significant risks for traders. If a centralized exchange is hacked, users’ funds can be stolen or lost entirely, leaving traders with little to no recourse.

The Mt. Gox hack in 2014 serves as a stark reminder of the risks associated with centralized exchanges. At the time, Mt. Gox was the largest Bitcoin exchange in the world, handling over 70% of all Bitcoin transactions. However, it was later revealed that the exchange had been hacked, resulting in the loss of 850,000 bitcoins, worth over $450 million at the time. The hack had a significant impact on the cryptocurrency market, causing the price of Bitcoin to plummet and leading to a loss of trust in centralized exchanges among many investors.

Another example of a centralized exchange being vulnerable to hacking and security breaches is the FTX scandal that occurred in July 2021. FTX, one of the largest cryptocurrency exchanges in the world, suffered a data breach that exposed the personal information of thousands of its users. The hackers managed to steal over $8 million worth of cryptocurrencies, including Bitcoin, Ethereum, and Litecoin.

These incidents highlight the risks of using centralized exchanges, where users’ funds and personal data are stored on a single server, making them a prime target for cyber attacks. Once a hacker gains access to the exchange’s server, they can easily transfer the funds to their wallets, leaving users with little to no recourse.

Decentralized exchanges (DEXs) are different in nature

On the other hand, decentralized exchanges (DEXs) operate on a peer-to-peer network without a central authority controlling the exchange of cryptocurrencies. They are built on decentralized blockchain technology, offering users more control over their funds.

One of the key benefits of DEXs is that they are not vulnerable to the same types of hacks as centralized exchanges. This is because users retain control of their private keys and are not required to trust a centralized entity to hold their funds. Additionally, DEXs are censorship-resistant, meaning they cannot be shut down or restricted by governments.

For example, a popular DEX is Uniswap, built on the Ethereum blockchain and uses smart contracts to facilitate trades. Users maintain control of their funds and trade directly with each other without the need for a centralized intermediary.

DEXs are designed to be “more Web3”, but…

While decentralized exchanges (DEXs) offer several advantages over centralized exchanges, they are not without their own set of drawbacks. One of the most significant drawbacks of DEXs is their limited liquidity. Unlike centralized exchanges, which often have large trading volumes and order books, DEXs generally have lower liquidity and smaller trading volumes. This can result in higher slippage and less favorable prices for traders.

Another disadvantage of DEXs is their complexity. DEXs are built on blockchain technology and require users to interact with smart contracts, which can be confusing for those who are not familiar with the technology. Additionally, DEXs may have a limited range of trading pairs available, making it difficult for traders to access certain cryptocurrencies.

Finally, DEXs are not immune to price manipulation. While DEXs are designed to be more resistant to market manipulation than centralized exchanges, it is still possible for bad actors to manipulate prices by using sophisticated trading strategies or by pooling their resources to create artificial demand or supply. This can result in traders suffering losses and undermining the trust in the DEX platform.

TL;DR which platform should I choose to trade crypto assets?

- Liquidity: CEX typically has higher liquidity than DEX due to its larger user base and higher trading volumes. This means that traders on CEX may have access to better prices and faster trade executions.

- Security: While DEX is generally considered more secure than CEX due to the decentralized nature of the platform, there is still a risk of hacking and security breaches. It is important to note that decentralized does not always mean completely secure, and users should still take appropriate measures to protect their assets.

- User Experience: CEX often offers a more user-friendly experience with a familiar interface, advanced trading tools, and customer support. DEX, on the other hand, may require users to have a basic understanding of blockchain technology and may have a steeper learning curve for beginners.

- Regulation: CEX is subject to more regulation and oversight than DEX, which operates in a more decentralized and unregulated environment. Depending on your perspective, this can be seen as a pro or a con.

- Asset Support: CEX often supports a wider range of assets than DEX, which may have limited token offerings due to technical limitations or lack of demand.

Overall, the choice between DEX and CEX depends on individual preferences and risk tolerance. Before deciding where to trade, it is important to carefully consider the pros and cons of each platform.

Decentralized exchange is a positive step forward

Wow, the article is longer than I expected, but I hope you got a better understanding of DEX and CEX after reading it. Again, the implementation of Web3 is an ongoing process and the development of decentralized exchanges is just one aspect of it. As with any new technology, it will take time to iron out all the kinks and ensure a seamless user experience. However, the potential benefits of a decentralized financial system are too great to ignore.

As a leader of a tech company like SupremeTech, I believe that the future of finance and many other industries powered by technology lies in the hands of the users. Decentralized exchanges are a step in the right direction for the future of Web3. We should continue to support and develop these platforms to create a more equitable and transparent financial system for all.

Related Blog